Ag Markets April 13, 2020

Agriculture futures are adjusting to different post-USDA, OPEC+, government stimulus, and weather-related crosscurrents this morning after the long Easter holiday weekend.

This weekend:

The OPEC+ group agreed to a 9.7mm barrel/day production cut beginning May 1st.

Covid-19 hot spots continue to ease: fewer NY patients, fewer Italian and French cases; Fauci sees select openings by May, MN Fed's Kashkari sees 18 months of false starts.

This is a busy week for economic data, with a focus on U.S. jobs, China data, and earnings:

U.S. Retail Sales and Empire Manufacturing (New York) data Wednesday

U.S. Jobless Claims (exp. +5.0mm new claims) Thursday

Chinese GDP (exp. -6.0%), Industrial Production, Retail Sales on Friday

Q1 earnings season kicks off: JPMorgan, Wells, Goldman, Citi, Schlumberger this week.

Macro sentiment has improved on the combination of COVID-19 curve-flattening, new CB stimulus (Fed now buys junk bonds), and OPEC+ energy market backstops. The S&P 500's +12% rally last week was the best since 1974. This morning S&P 500 futures are ~flat, brent crude is up +4.0%.

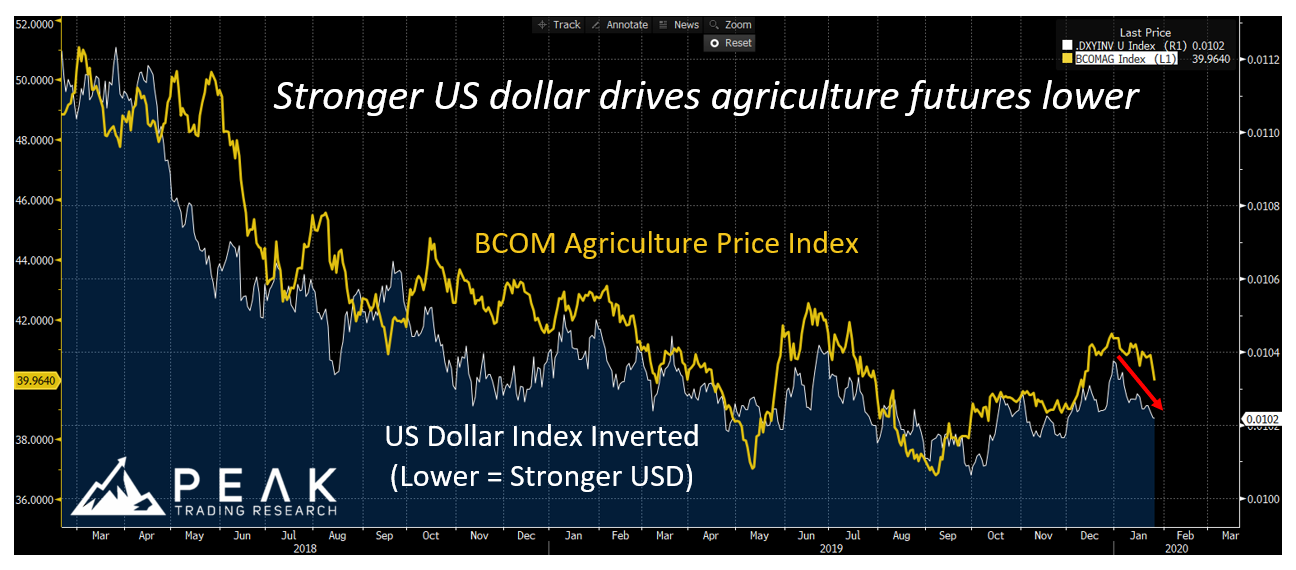

The U.S. Dollar remains an x-factor; USD has been steady, torn between miserable weekly employment numbers (negative dollar) and flight-to-safety funding flows (positive dollar).

We're approaching an important inflection point for price seasonals in agriculture markets; corn, chicago wheat, soybeans, and meal futures prices tend to rise in May and June. The seasonal spring low for these markets, basis front-month prices the past 10 years:

Corn = April 20th (next Monday)

Chicago Wheat = May 7th

Soybeans = May 10th

Soybean Meal = May 2nd

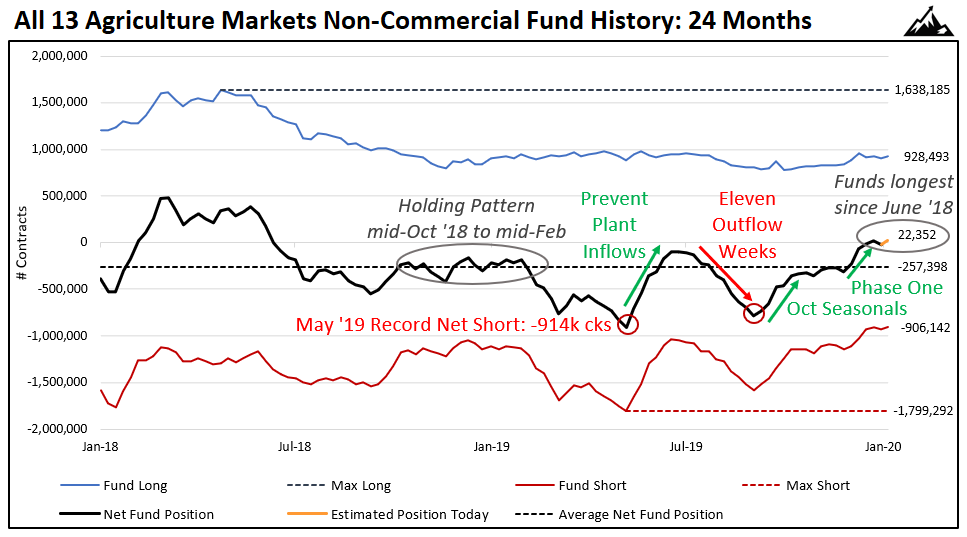

This weekend's COT positioning report was relatively quiet, showing small net outflows from corn, chicago wheat, meal, and sugar. The two main COT takeaways:

Recent macro volatility has driven HFs to cut positions and hedge fund gross exposure remains low, near levels last seen in Jan 2012. Long interest in the soy complex is at new multi-year lows (chart below).

Hedge fund positioning is a ~neutral input overall: white sugar and matif wheat join chicago wheat and arabica as the expensive and overbought markets.

What Matters for Ag Futures This Week:

Covid-19 curve-flattening and massive government stimulus packages have boosted sentiment and last night's OPEC+ decision removes the tail risk of $10/barrel crude.

For our agriculture futures markets, the US dollar is still a missing macro puzzle piece - a weaker US dollar (esp vs BRL) would be a solid tailwind for agriculture futures and would push our macro rating into positive territory.

Price seasonals (still slightly negative for the coming weeks) and market structure (neutral) are less important inputs in light of the massive macro volatility we've been seeing.

Watch data this week - especially China on Friday - and watch the U.S. dollar. USD down = Ags up.

Chart of the Week: Macro volatility, negative China sentiment, big South American production numbers, and a strong US dollar have been big headwinds for soybean, meal, and bean oil prices. Speculative long positions across the soy complex are at multi-year lows.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets April 6, 2020

The macroeconomic environment will again be the main non-fundamental driver for agriculture futures this week (the USDA's WASDE production report is this Thursday); focus will be on:

Evidence we're nearing an apex in Covid-19 cases (Italy, Spain, France cases lower... U.S. and U.K. two weeks away?)

OPEC+ meeting on Thursday, possible coordinated crude production cuts

U.S. jobless claims data on Thursday (fewer claims than last week's record +6.6mm?)

Last week agriculture markets saw mixed macro signals: crude up +19.5% on OPEC+ optimism (good for ag futures prices) vs U.S. dollar up +2.2% on flight-to-safety flows (bad for ag prices).

This morning S&P futures are up +3.0%, crude oil down -2.0%, USD flat.

Price seasonals remain negative for agriculture futures in April (exception cocoa and canola seed) before turning more positive in May. It's still too early to call the seasonal turn into U.S. planting.

This weekend's COT positioning report was relatively quiet: small net inflows, mostly chicago wheat (new longs) and soybeans (short covering). The two main COT takeaways:

Recent macro volatility has driven HFs to cut positions in ag futures at a record pace over the past month; hedge fund gross exposure is down to levels last seen in Jan 2012 (chart below).

Hedge fund positioning is a ~neutral input overall: chicago wheat and arabica look overbought; corn, cotton, cattle look cheap and oversold.

What Matters for Ag Futures This Week:

There are competing macroeconomic forces for agriculture markets:

The boost in risk sentiment from flattening the curve / nearing the Covid apex and prospect of higher energy prices are positive tailwinds for ag prices.

The U.S. dollar's persistent strength - and associated weakness in Brazilian real and Argie peso (both at new all-time lows) - are big negative headwinds for ag prices.

What would make the macro environment positive for ags?

Proof that we've crossed the apex, stable energy markets, and a weaker USD. We're not there yet.

Watch U.S. jobless claim numbers and watch headlines coming out of the OPEC+ meeting, both on Thursday (same as the WASDE report). Markets are closed on Friday for the Good Friday holiday.

Chart of the Week: Bets are off: Recent macroeconomic volatility has driven speculators in agriculture futures to cut their positions at a record pace over the past month; hedge fund total positioning is down to levels last seen in January 2012.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets March 30, 2020

This week we see the USDA's stock and acreage reports tomorrow (March 31st), followed by two big U.S. employment reports: weekly U.S. jobless claims Thursday, monthly U.S. nonfarm payrolls data Friday.

Markets have priced in a lot of positive government stimulus over the past week (S&P rallied +10.0%, best week in 11 years), including the Fed's interest rate cuts and the $2T fiscal stimulus package signed Friday.

Investor focus will now shift back towards the duration and severity of the Covid-19 outbreak, extended business shutdowns, and impact on the global economy. Headlines were negative this weekend: Confirmed Covid-19 cases in the U.S. are approaching 150k (globally 750k), Trump has backed off his Easter opening push, U.K. might be on lockdown for six months, Italian Covid-19 deaths > 10k.

Beyond the negative macro environment, price seasonals remain bearish for agriculture futures in April (exception cocoa and canola seed) before turning more positive in May. Most agriculture futures seasonal price patterns point to selling in April.

This weekend's COT positioning report was relatively quiet: we saw small short-covering inflows in chicago wheat, kansas wheat, soybeans, and meal...all markets with fundamental stories (U.S. wheat/pasta stockpiling, potential Russia export quotas, Argentina port closures). Chicago wheat, soybean meal, matif wheat, arabica coffee, and white sugar look expensive & overbought vs data from the past 24 months; cattle, cotton, and corn stand out as cheap & oversold.

What Matters This Week:

Tomorrow's USDA stocks & acreage reports will be a significant fundamental driver as the market prices new farmer-projected planted acreage and production numbers.

The macro environment will again be the main non-fundamental input for ag markets and we're getting deeper into Covid-19 impacted data this week. This Friday's NFP jobs report will likely be the first negative print since Sep 2010 (-100k jobs expected). Tomorrow is also quarter end, which could lead to additional funding market and macro volatility.

Aside from the negative macro environment, seasonals are still a headwind for prices in our markets and structure looks bearish for overbought markets like chicago wheat, arabica coffee, and soybean meal - these markets have plenty of headwinds, especially if fundamentally-driven buying pressure abates.

Bottom line: Beyond the USDA stock/acreage #s tomorrow, watch market sentiment via S&P 500 / crude oil / U.S. dollar and trader reaction to the two big job reports on Thursday and Friday this week. USD weakened a lot last week, any restrengthening on this week's job reports would negatively impact our markets.

Chart of the Week: Covid-19 is causing dislocations in agriculture markets. Flour and pasta stockpiling has driven wheat futures to five-year highs vs corn futures.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets March 23, 2020

Agriculture markets have largely disconnected from the negative macro mood as bullish fundamental inputs (Argentina port strikes, China cargo buying) have lifted futures and triggered momentum trader short stops.

Looking forward, momentum and trend-following CTA positioning is less of a bullish input for markets like chicago wheat, kansas wheat, soybean meal, and arabica coffee.

The macroeconomic environment is a significant headwind for agriculture prices and will be the main non-fundamental input for traders this week.

S&P 500 futures have locked limit down this morning after the U.S. govt failed to pass a $2T stimulus bill. The S&P 500 is now down -35% from Feb 19th, just 23 trading sessions ago (chart below).

On the calendar this week:

Tuesday: PMI manufacturing data from Europe, U.S., Asia

Tuesday: G7 Foreign minister summit (was planned for Pittsburgh, now a teleconference)

Thursday: US jobless claims; Over +1.5mm claims expected vs +281k last week, 500%+ jump

Thursday: Bank of England; already cut rates twice in March to 0.1% + more QE

Price seasonals remain broadly negative in March but turn more positive into April.

This weekend's COT report showed record aggregate long liquidation outflows from both non-commercial (-186k cks) and managed money (-246k cks) hedge funds, partially offset by short covering inflows. It's worth noting that chicago wheat, soybean meal, and arabica coffee now look expensive and overbought versus data over the past two years.

What Matters This Week:

Progress on passing U.S. fiscal stimulus measures (hopefully later today) and U.S. jobless claim numbers on Thursday will be big drivers for investor sentiment.

U.S. jobless claim numbers this Thursday at 13:30 GVA, 7:30am Chicago are the best "live" look at how Covid-19 is impacting the U.S. economy. Looking forward, these weekly unemployment insurance claim reports will be big S&P 500 and U.S. dollar movers; "Jobless claims are the new Nonfarm payrolls".

Aside from the macro environment, keep an eye on how chicago wheat, soybean meal, and arabica coffee perform after recent hedge fund inflows. We've seen fundamental traders, carry traders, and momentum CTAs push these three markets into "expensive and overbought" territory; these markets are the new "tallest nails" of the ag complex...like the sugar markets were a month ago, caveat emptor.

Bottom line: Watch U.S. govt fiscal stimulus progress today, watch jobless claim numbers on Thursday, and watch market sentiment via S&P 500 / crude oil / U.S. dollar. Our markets still have plenty of non-fundamental headwinds.

Chart of the Week: The S&P 500 index is now down -35% from the February 19th market highs, a record-fast drop spanning only 23 trading sessions.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets March 16, 2020

The macroeconomic environment will again be the primary driver for agriculture futures this week.

The U.S. Federal Reserve introduced a massive stimulus package last night including 100bps of rate cuts, $700B in QE4 bond buying, new repurchase and credit facilities, and new US dollar central bank swap lines.

The Fed's goal is to increase liquidity, lower the cost of money, backstop markets, and boost investor confidence.

Under normal circumstances this Fed bazooka would weaken USD and drive up inflation expectations (good for agriculture prices), but today we're seeing overwhelming Covid-19 risk-off trading: US stock futures are locked limit down, US treasury rates and bonds are rallying (lower yields), crude oil -5.0%, U.S. dollar weaker, Gold firmer. Most ag futures are down ~1% in the overnight session.

For our agriculture futures markets, there are no macro positives to point to today. Correlations to major macro indices are strongly positive (many in the upper 1st percentile), which is dragging our markets lower.

Other non-fundamental inputs for agriculture markets are mixed:

Price seasonals remain broadly negative until mid-April (U.S. planting risk).

Market structure is a ~neutral input overall, hedge funds still have room to sell.

Momentum CTA traders are the shortest they've been in 24 months.

What Matters This Week:

Investors want to see how markets react to the Fed's emergency policy measures. Nine other central banks are also scheduled for this week including the RBA, RBNZ, and BoJ. Investors want to see more aggressive monetary and fiscal backstop efforts.

The gamma on reported Covid-19 cases isn't slowing, new cases are approaching ~200k.

Economic data matters less this week with all the central bank noise. That said, it's worth noting China's Feb manufacturing, retail sales, and investment numbers cratered this morning.

It's another week to be very careful with long futures positions in agriculture futures. A firmly negative macro environment combined with negative March price seasonals points to further downside for our markets.

Chart of the Week: Strong risk-off trading continues today despite the U.S. Fed’s historic stimulus measures last night. This matters for agriculture markets: correlations between macro indices and ag futures have risen significantly over the past two weeks. The macro environment is a strong negative headwind for commodities today.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets March 9, 2020

Global macro risk indices turned lower on Friday and markets are in free-fall this Monday morning with crude down -25% (biggest drop since 1991), S&P 500 futures limit down -5%, and 10yr US bond yields at record lows below 50bps.

The US dollar is cratering to 13-month lows this morning on further Fed rate cut expectations; this USD weakness is the only lifeline for our agriculture futures markets in a sea of red.

Big drops in energy prices (and the knock-on effects for inflation expectations and ag input prices) are broadly negative for agriculture markets, especially bean oil, sugar no. 11, arabica coffee, and cotton - see our chart of the week below. This Opec-driven crude drop adds a new and significant headwind for agriculture futures markets.

Like last week, investor focus will be on coronavirus contagion (reported cases now >110k), central bank support, market price action, and economic data:

The ECB meets this Thursday. The ECB's deposit rate is already negative at -0.50bps; they could push further negative (10-20 bps?) or open additional financing lines.

The U.K. government releases its new budget this Wednesday, which could include emergency fiscal or liquidity measures ahead of the BoE meeting March 26th.

Next U.S. Fed policy decision is next Wednesday, March 18th (2+ more 25bp cuts priced in as of this morning).

Last week's stale Feb Nonfarm payroll numbers were great, with +273k jobs created. We'll get into more recent corona-impacted data starting with March US consumer sentiment data this Friday.

Price seasonals remain broadly negative in March, esp for the sugar markets, beans and meal. Our seasonal heat maps have more red than green until mid-April.

This weekend's COT report showed larger-than-expected short covering inflows into soybeans and soybean meal, but otherwise we've seen funds selling (long liquidation, new shorts) over the past month, driven by the negative macro.

Market structure is a ~neutral input overall, with today's aggregate fund position matching the average position of the past 24 months. Momentum traders ("first movers") have been selling ag futures and today these traders are the shortest they've been in six months according to our internal models.

What Matters This Week:

The macro environment will be the #1 price input for ags again this week, likely overwhelming the impact from Tuesday’s March USDA WASDE report. Investors will focus on corona contagion and central banks' ability to backstop growth expectations and capital markets.

The ECB is on deck Thursday at 13:45 GVA, 7:45am Chicago following the Fed's emergency -50bp rate cut last week. Investors want to see real action and additional market stimulus.

Negative March price seasonals are a headwind and will continue to weigh on agriculture markets over the near term.

Market structure is a more neutral input overall but there are still a few markets where funds are relatively long vs data the past 24 months: matif rapeseed, white sugar, cocoa, matif wheat, sugar no.11, chicago wheat, and arabica coffee.

It's another week to be careful with long futures positions: strongly negative macro + negative March seasonals = headwinds for ag futures prices.

Chart of the Week: Today’s Opec-driven crude oil price rout is dragging agriculture futures markets lower in the overnight session. Big drops in energy prices are broadly negative for agriculture futures, especially bean oil, sugar no. 11, arabica coffee, and cotton.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets March 2, 2020

We're entering another week where the negative macro environment will be the #1 non-fundamental driver for agriculture prices. March negative price seasonals are a headwind. Market structure is becoming a more neutral input (hedge funds less long) after a month of macro-driven hedge fund selling.

The macro environment was sharply negative last week on Covid-19 contagion headlines, with many stock and interest rate indices seeing the biggest weekly declines since 2008. Investors saw true risk-off trading.

This week investors will focus on 1.) coronavirus contagion, 2.) central bank financial market backstops, 3.) economic and political data.

The next scheduled Fed policy decision is March 18th, the ECB is March 12th. Markets are pricing in a 50bp March Fed rate cut this morning (vs 33bps on Friday). Central banks could agree to the first coordinated effort since post-Lehman in Oct '08.

Data this week: U.S. manufacturing surveys today, NFP job #s on Friday. Super Tuesday primaries tomorrow could also move markets; Biden is seen as the more investor friendly candidate vs Sanders. Data is likely a very distant third concern for investors this week.

Price seasonals are broadly negative in March; ag futures prices will continue to remove a risk premium around South American production.

Market structure is becoming a more neutral input after a month of macro-driven hedge fund selling. Hedge funds are ~252k contracts net short ag markets in aggregate, effectively matching the 24-month average of -243k contracts. CTA momentum traders are the shortest they've been in six months.

What Matters This Week:

The macro environment will be the #1 input for ags again this week and corona contagion will be investors' main focus. Central bank policy changes, including any coordinated policy changes, would be a plus for risk assets. Economic data will take a back seat this week.

Negative price seasonals are a headwind and will continue to weigh on our markets over the coming weeks.

Market structure is a more neutral input overall, but some markets still stand out as expensive and overbought: sugar no. 11, white sugar, matif rapeseed, oats, and cocoa (record long leg).

It's another week to be careful with long futures positions: the firmly negative macro environment and negative March seasonals are headwinds for ag futures prices.

Chart of the Week: Price performance for agriculture futures has been broadly negative in February, largely driven by the strongly-negative macroeconomic environment; only 5 of 26 agriculture futures markets finished the month higher: arabica coffee, soybean meal, dalian beans, lean hogs and soybeans.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets February 24, 2020

The macroeconomic environment feels worse coming into the week with S&P futures down over -1%, crude down -2.5%, USD up +0.3%. Ag markets are broadly lower in the overnight session this Monday morning.

The macro environment will again be the #1 non-fundamental driver for ag futures this week, with a big focus on coronavirus' impact on global data and newly reported cases in South Korea, Italy, and Iran.

Last week was mixed for data: New York and Philly Fed surveys were great but more forward-looking PMI manufacturing factory order numbers last Friday were the lowest since 2013. The yield on 30-year U.S. bonds are at all-time lows, gold is at 7-year highs.

The data calendar is empty this week; coming up: China manufacturing numbers this Saturday (Feb 29th), Super Tuesday (March 3rd), and U.S. NFP job numbers next Friday (March 6th).

Price seasonals are broadly negative for agriculture futures; this is the time of year when traders are comfortable removing a price risk premium around South American production. We certainly saw this last year when hedge funds sold ~620k contracts of agriculture futures between mid-Feb and mid-May 2019.

Market structure still looks like a broadly bearish input; funds are longer vs the 24-month average due to big/record long positions in markets like chicago wheat, white sugar, arabica coffee, and cocoa.

What Matters This Week:

Coronavirus will be the market's main focus, especially given the negative drag on forward-looking data last week. We're seeing true "risk-off" trading this morning with equities down, energy markets down, industrial metals down, and US dollar up...a miserable combination for agriculture futures.

Add in bearish price seasonals and extended-long fund positioning and most non-fundamental factors are headwinds for futures prices today. Be careful with long positions in this environment, especially for markets with massive fund long interest.

Chart of the Week: We’re in a broadly bearish seasonal period for agriculture futures prices and markets like kansas wheat, chicago wheat, and sugar #11 have firmly negative price patterns worth noting, e.g., for kansas wheat: KWK prices have fallen in 16 of the past 18 years the 34 trading days after Feb 25th (tomorrow).

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets February 17, 2020

We're entering another week where the macroeconomic environment will be the most important non-fundamental driver for agriculture prices.

The macro mood improved into the end of last week: Chinese stock markets and currency markets benefited from liquidity support and global energy markets rebounded, which had positive knock-on effects for inflation expectations.

US Dollar strength remains a big headwind for agriculture futures markets and this morning DXY is matching levels not seen since early October.

Markets are closed for US Presidents' Day today, but later in the week we see a few second-tier data points - Empire Manufacturing (Tues), PPI Inflation (Wed), Philly Fed (Thurs) - as well as earnings from Glencore (Tues) and Wilmar (Thurs). On the fundamental side we have the USDA Ag outlook forum starting Thurs.

Price seasonals are negative looking forward. This is the time of year when traders are comfortable removing a price risk premium around South American production. The normalized seasonal line for our 13 agriculture markets accelerates lower in late February (chart of the week below).

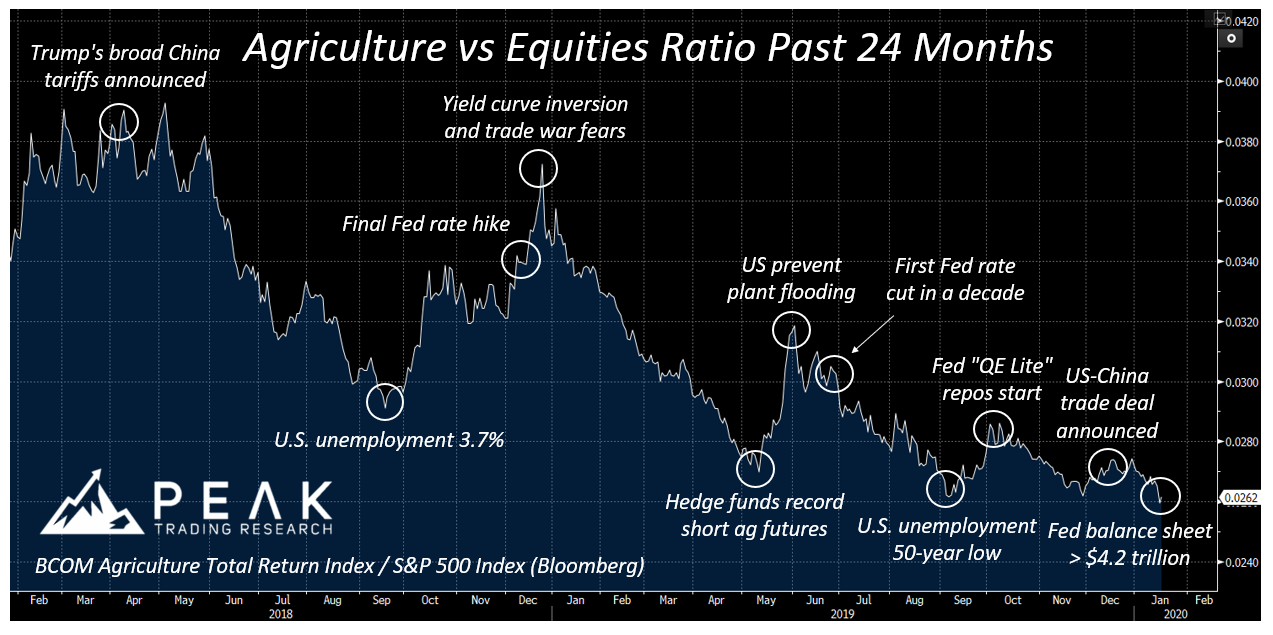

Market structure still looks like a broadly bearish input (funds are long), even after two weeks of COT report outflows. Today we estimate hedge funds are ~116k contracts net short the 13 agriculture markets in the CFTC supplemental report, still *above* the 24-month average of -239k contracts. Last year at this time funds started selling towards a record net short position of almost a million contracts by mid-May.

What Matters This Week:

The macro environment remains fluid and we've seen our macro rating bounce between negative and neutral over the past month, mostly driven by China / energy / currency moves. Keep watching CNY and Chinese A-shares as well as the US dollar index, especially vs the Brazilian real and Argentine peso.

Negative price seasonals are a headwind and will weigh on our markets over the coming weeks.

Markets with fundamental stories and massive fund long interest (arabica coffee, chicago wheat, white sugar, cocoa) stand out as expensive and overbought. If the macro mood worsens again, these markets look vulnerable...especially against the backdrop of negative price seasonals.

Chart of the Week: We’re entering a period of the year when agriculture traders are comfortable removing a price risk premium around South American production. Futures prices tend to accelerate lower in late February. We saw this last year when funds started selling towards a record net short position by mid-May.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets February 10, 2020

This is a big week for agriculture futures markets, with fundamental USDA data on Tuesday and an ever-changing macro environment marked by improved China sentiment (good for ags) but also a much stronger US dollar (bad for ags).

Last week we saw the macro mood stabilize with Chinese market liquidity injections and better-than-expected US manufacturing and employment data (NFP jobs at +225k vs +165k exp).

This week is quieter for planned macro events: Fed chair Jerome Powell sits for his semi-annual testimony before Congress tomorrow (plenty of questions around the US consumer and coronavirus) and we see Q4 GDP numbers from the U.K. (Tuesday) and Germany (Friday).

Prices seasonals are still fairly negative looking forward, especially for grains (including oats and rice) and the sugar markets. Prices tend to trend lower for a few key markets over the coming months.

Market structure still looks like a broadly bearish input, even after Friday's COT report showed the largest hedge fund outflows in six months. We're seeing a growing rift between markets with fundamental stories and new fund record-long interest (chicago wheat, sugar, cocoa) versus markets getting hit hard by negative coronavirus / china macro headlines (funds record short soybean meal, chart below).

What Matters This Week:

We're entering another week where the macro environment will be the #1 non-fundamental driver for agriculture prices.

Keep watching Chinese sentiment barometers CNYUSD and A-shares as well as the US dollar index, especially vs the Brazilian real and Argentine Peso. Chinese capital markets have stabilized (good for risk sentiment and ags) but BRL and ARS are falling quickly vs USD (very bad for ags).

If the macro environment continues to improve (China up, USD down), soybean meal looks too oversold; if the macro environment worsens (China down, BRL further down), sugar looks too overbought.

The macro environment matters this week, especially once we get past WASDE numbers tomorrow. Watch Chinese markets, watch USD, watch BRL.

Chart of the Week: With China sentiment turning sharply lower on coronavirus headlines, this past Friday’s COT positioning report showed hedge fund traders put on record-large short bets in soybean meal futures, which drove soybean meal futures prices to new cycle lows last week. The macroeconomic environment has broad implications for our agriculture markets today.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets February 3, 2020

Agriculture markets are facing non-fundamental headwinds as we enter February. The macroeconomic environment is negative, price seasonals turn more bearish, and hedge funds are overextended long in a few key markets against these more negative price drivers.

The macro environment is firmly negative and last week was a second week where most of the macro drivers that matter most for agriculture commodities turned lower. Broad risk sentiment is negative, energy and metals momentum is downward, inflation expectations are lower. China's equity and fx markets are re-opening lower today, with A-shares down ~10%.

Price seasonals turn more negative this month, especially for the wheat and sugar markets...both of which look overbought with Friday's COT showing record long positions in both Chicago wheat and white sugar.

Market structure still looks like a bearish input, even with prices falling and funds likely selling ~100k contracts through the end of last week. There are still plenty of agriculture markets where funds are extended long vs data from the past 24 months: sugar #11, white sugar, Chicago wheat, arabica coffee, bean oil, cocoa, and matif rapeseed. Risks are skewed to the downside for these markets if macro volatility drives traders to trim big long positions.

What Matters This Week:

Risks are again skewed to the downside for our agriculture markets with non-fundamental factor alignment across the macroeconomic environment, seasonal price trends, and market structure. Hedge funds added big new longs over the past four months and those positions look vulnerable today, especially with the negative macro mood.

Coronavirus and China market volatility will be an investor focus this week. In the U.S. we have Iowa caucuses and ISM manufacturing data today, Trump's state of the union Tuesday night, and U.S. Nonfarm payrolls Friday (+160k jobs exp). Argentina meets with the IMF to discuss credit lines Wednesday.

The U.S. job numbers Friday (14:30 GVA, 7:30am Chicago) will likely be the biggest macro risk and U.S. dollar data point this week. A strong jobs report would drive USD back towards multi-month highs...another macro headwind for our markets.

Like last week, be cautious with long futures positions in this environment, esp in overbought markets like sugar, Chicago wheat, cocoa, and bean oil. These markets still look like great short candidates for hedge funds looking to express a bearish macro theme.

Chart of the week: Despite the firmly negative macroeconomic tone over the past two weeks and broad commodity selling, there are still plenty of agriculture markets that look overbought (fund positioning skewed long) and expensive (prices above the 24-month average) today.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets January 27, 2020

Hedge funds are trimming risk and liquidating recently-added long positions in the face of a worsening macroeconomic environment (broad risk-off trading, US dollar stronger) and ahead of negative February price seasonals.

Last week we saw the macroeconomic mood worsen on coronavirus headlines, driving the US dollar up and stock markets, energy markets and inflation expectations down. We're starting this week with a similar negative tone. This week's scheduled macro events include a U.S. Fed policy decision Wednesday (no policy change expected for all of 2020) followed by U.S. 4Q GDP and a Bank of England policy decision Thursday (possible interest rate cut).

Price seasonals turn more negative as we get into February. This week we enter the most negative multi-month periods of the year for a few major agriculture futures markets (many of which are currently expensive and overbought vs data the past 24 months). Our seasonal heat maps have a lot more red looking forward.

Market structure still looks like a bearish input. Hedge funds are around the longest they've been in ag futures since June '18. Funds are especially long in markets like sugar #11, white sugar (record long), chicago wheat (record gross long leg), arabica coffee, bean oil, cocoa, and matif rapeseed (record long).

What Matters This Week:

We see some bearish non-fundamental factor alignment building across our markets with the macro environment downgraded to negative, market structure bearish (funds broadly long), and seasonals turning more negative over the coming weeks.

The macro environment will remain the most fluid non-fundamental driver and is a headwind for agriculture prices coming into this week. Along with coronavirus headlines, watch the Fed announcement Wednesday at 20:00 GVA, 1:00pm Chicago and the BoE announcement Thursday at 13:00 GVA, 6:00am Chicago. The Fed will likely be a non-event but a dovish BoE (e.g. rate cut) would drive USD up and our agriculture markets lower.

Chart of the week: The US dollar has strengthened +1.5% in January and is getting a flight-to-safety bid coming into this week. A stronger US dollar has been a big headwind for agriculture futures over the past two years. This week’s U.S. Fed decision, U.S. GDP, and BoE rate decision are the next USD catalysts.

For a trial of our industry-leading agriculture research, reach out to us: insight@peaktradingresearch.com.

Ag Markets January 20, 2020

The main non-fundamental price drivers for agriculture markets this week = bullish January price seasonals vs increasingly bearish market structure with the macroeconomic environment (~neutral) as the x-factor ahead of a big week for central banks.

Price seasonals are bullish for agriculture futures through the end of the month before turning lower as we enter February, especially in the grain markets.

Market structure is getting more bearish: hedge funds are the longest they've been in ag futures since June '18 and Friday's COT report showed the fourth largest buying week on record for sugar no. 11 and white sugar (record new longs).

Like the broader market structure picture, momentum CTA traders (~25% of the hedge fund pie) are still extended long. These momentum traders try to be the "first movers" and front-run bigger swings...it's interesting to note that they added to long risk in corn, soybeans, and cattle on Friday.

The macro environment is ~neutral for ags ahead of a big week for central banks: Bank of Japan Tuesday, ECB Thursday, with U.S. Fed and Bank of England decisions next week. The ECB is likely the biggest dollar driver with Lagarde set to outline a top-down review of the ECB's targets and approach. USD is at three-week highs this morning. The Davos meetings and U.S. impeachment proceedings this week make for interesting headlines but shouldn't move ag futures markets much.

Bottom Line: It's another week where the macro environment will be the tiebreaker and swing factor between bullish January seasonals and bearish extended long fund positioning. The main macro event this week is the ECB rate decision this Thursday starting 13:45 GVA, 6:45am Chicago. Watch the impact on the US dollar: EUR down = USD up = ag futures down.

Chart of the week: Recent central bank stimulus (Fed balance sheet up > 10% since September) has helped risk assets broadly, but our agriculture markets haven't kept up. Today the ags vs equities ratio is making new all-time lows.

For our full weekly report or for a trial of our research, reach out to us: insight@peaktradingresearch.com.

Ag Markets January 13, 2020

With Friday’s big USDA report now behind us, this week it's all about seasonals vs structure.

Price seasonals are bullish for ag futures in January; futures tend to rally on new year inflation hedging and South American weather concerns.

Structure is getting more bearish: hedge funds are the longest they've been in ag futures since June '18 (see our chart of the week below). Markets like bean oil, chicago wheat, arabica coffee, matif rapeseed, and sugar look overbought. Our models show that momentum CTA traders are also extended long on positive momentum signals across most ag markets.

The macro environment is downgraded to neutral this week. Crude backed off 8-month highs and the US dollar re-strengthened last week...both headwinds for ag futures prices. Last Friday's Nonfarm payroll job numbers were on the weak side at only +145k jobs (vs exp. +160k).

The macroeconomic environment is the biggest x-factor for our markets this week…a neutral input today, but that could change quickly. Investor focus is shifting from Iran to the US-China phase one trade deal signing in Washington on Wednesday. Ag traders will want concrete details around Chinese farm good purchases. Signals around phase two deal momentum would be a positive macro kicker.

January seasonals will be the clearest positive non-fundamental driver for our markets over the near term.

Market structure + CTA positioning becomes a concern if some fundamental / macro / technical trigger causes traders to liquidate big long positions. This is especially relevant for arabica, bean oil, and rapeseed.

Big picture: Although we don't have non-fundamental factor alignment coming into this week (seasonals = bullish, macro = neutral, and market structure = increasingly bearish), the macro environment is a big swing factor and could tip the scales in either direction.

For our full weekly report or for a trial of our research, reach out to us: insight@peaktradingresearch.com.

Ag Markets January 6, 2020

As we enter the first full trading week of the calendar year and ahead of Friday's big USDA numbers, the non-fundamental message for agriculture markets this week: bullish January price seasonals and a positive macroeconomic environment (crude up, inflation expectations up) vs increasingly bearish market structure (hedge funds are extended long, especially momentum CTA traders).

Watch the macro environment closely this week, especially crude oil, S&P 500, and the US dollar. Ag markets are being buoyed by stronger energy markets (and positive Jan seasonals) but if the macro mood sours and hedge funds bail on macro/inflation hedges, that would make overbought markets like bean oil and coffee look vulnerable to profit taking. Watch Iran headlines (crude oil driver) and US job numbers Friday at 14:30 GVA, 7:30am Chicago (next USD driver).

Chart of the week: Markets like bean oil, sugar and coffee are especially sensitive to volatility in energy markets and perform well when crude jumps.

For our full weekly report or for a trial of our research, reach out to us: insight@peaktradingresearch.com