The Best Commodity Breakout Strategy - How to Trade Breakouts

Commodity markets are great breakout markets.

You can make a lot of money as a commodity trader by buying higher highs and selling lower lows.

Today, we’ll review the simplest breakout trading approach that works in many of the world's biggest commodity markets, like Crude Oil, Heating Oil, Gasoline, Gold, and Soybeans.

And we'll examine the results from 60,500 different tests to see what is the best agriculture market for breakout trading and what is the best energy market for breakout trading.

Breakout strategies work.

We're going to see in which markets they work best.

Let's get into it.

BUILDING A GREAT BREAKOUT STRATEGY

Today we're going to be building the simplest breakout strategy that we can test across a lot of different markets and bar sizes to prove definitively what are the best breakout markets.

We know that breakout trading is buying a higher high, or selling short a lower low, holding that position for some period of time, and hoping to make a profit.

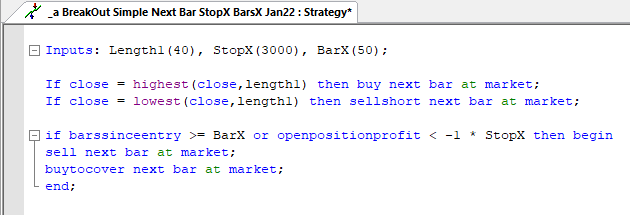

Let's start by jumping into some very simple EasyLanguage trading strategy code that illustrates how we're going to test this idea.

Simple Breakout Strategy Code

What is this complete trading system doing?

If the market closes at the highest level of the last 40 bars, the system will go long.

If the system closes at the lowest level of the last 40 bars, the system will go short.

Exits: if 50 bars have passed, or if the trade has lost more than $3,000 per contract, this system will exit the long or short trade.

This is a very simple but effective trading approach.

If the market goes up, you buy it.

If the market goes down, you sell it.

You get out after a certain amount of time and you've got a stop loss.

Simple stuff.

OPTIMIZATION

This is the fun part.

We can play around with those inputs in our strategy and test them across a lot of different markets and bar sizes to really tell us what are the best breakout markets. Our Algo Lab trading platform at PeakAlgo.com allows us to quickly test these different parameters.

We are going to test our length parameter from a value of 10 to 50. So if we were using daily bars in our chart, we'd be testing it from 10 to 50 days.

We're going to test a stoploss value from $1,000 to $5,000 per contract.

And we're going to test our exit bars also from a value of 10 days to 50 days.

So that's 5 (length) x 5 (stop) x 5 (exit bars) parameters = 125 different parameter combinations.

We're then going to test those parameter combinations across 44 different futures markets and 11 different bar sizes, e.g., 60 min bars, 180 min bars, 360 min bars, etc.

125 parameter combinations x 44 markets times x 11 bar sizes = 60,500 different tests.

Our Algo Lab platform tells us that there are nine different commodity markets in which our simple breakout trading system generates a significantly positive profit.

And that includes realistic slippage and commission costs.

Over the past 10 years, the best commodity markets for breakout trading are Crude Oil, Heating Oil, Gasoline, Soybeans, Soybean Meal, Lean Hogs, Gold, Palladium, and Silver.

THE BEST AGRICULTURE MARKET FOR BREAKOUT TRADING

The Lean Hogs market is one of the best agriculture markets for breakout trading.

The extremely simple breakout trading approach we tested on Lean Hog daily bars generates a pretty impressive cumulative equity line (below).

This tells us that if you're a professional commodity trader and you're trading Lean Hog futures, you should consider buying higher highs and selling lower lows.

Once Lean Hog futures start moving, they tend to keep moving. Our simple breakout trading strategy shows us that.

Profits: Breakout strategy equity curve (cumulative profit line) in the Lean Hogs market

THE BEST ENERGY MARKET FOR BREAKOUT TRADING

On the energy side, what is the #1 energy market for breakout trading?

The energy market that is responsible for this beautiful-looking cumulative equity line?

Heating Oil.

Equity curve in heating oil market running breakout strategy

Just to review, what have we done today?

We've built a simple breakout trading system.

We've tested the system across a lot of different markets and bar sizes (60,400 tests)

The results from our tests show us that some of the biggest and most well-known markets like Crude Oil, Gold, and Soybeans are great breakout markets.

Lean Hogs and Heating Oil are exception breakout markets.

Hopefully, this article helps you build, analyze, and trade breakout strategies across different agriculture, energy, and metal commodity markets.

For full access to our Algo Lab strategy testing tool, visit www.PeakAlgo.com and for our quantitative commodity research, visit www.PeakTradingResearch.com.